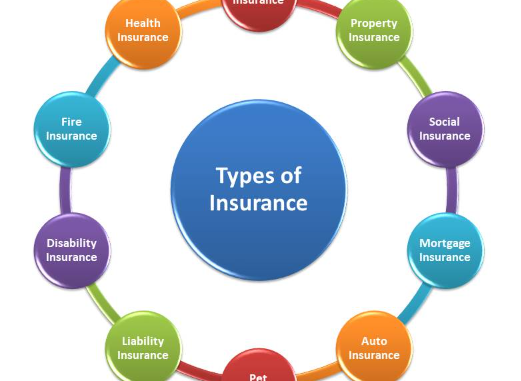

Insurance is a financial tool that provides protection against a wide range of risks and unexpected events. Understanding the most common types of insurance is essential for individuals and businesses alike. In this comprehensive guide, we’ll explore the key insurance categories and their importance in safeguarding various aspects of life and business.

1. Health Insurance:

Importance: Health insurance is a critical form of coverage that provides financial support for medical expenses. It ensures access to healthcare services, offering peace of mind and financial protection during illness or injury.

Types:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- High Deductible Health Plan (HDHP)

2. Auto Insurance:

Importance: Auto insurance protects drivers and their vehicles in the event of accidents, theft, or damage. It is a legal requirement in most places, and it offers financial security in case of unexpected automotive incidents.

Types:

- Liability Insurance

- Collision Coverage

- Comprehensive Coverage

- Uninsured/Underinsured Motorist Coverage

- Personal Injury Protection (PIP)

3. Homeowners Insurance:

Importance: Homeowners insurance safeguards your home and personal property from damage, theft, or liability claims. It provides financial protection and peace of mind for homeowners.

Types:

- Dwelling Coverage

- Personal Property Coverage

- Liability Coverage

- Additional Living Expenses (ALE) Coverage

- Scheduled Personal Property Coverage

4. Life Insurance:

Importance: Life insurance provides financial security for your loved ones in the event of your passing. It offers peace of mind and can cover debts, funeral expenses, and ongoing financial needs.

Types:

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Variable Life Insurance

5. Disability Insurance:

Importance: Disability insurance replaces a portion of your income if you become disabled and cannot work. It ensures financial stability and covers everyday expenses during a disability.

Types:

- Short-Term Disability Insurance

- Long-Term Disability Insurance

6. Business Insurance:

Importance: Business insurance protects companies from various risks, including liability claims, property damage, and business interruption. It is essential for mitigating financial losses and maintaining business continuity.

Types:

- General Liability Insurance

- Property Insurance

- Professional Liability Insurance

- Workers’ Compensation Insurance

- Business Interruption Insurance

7. Renters Insurance:

Importance: Renters insurance covers personal property and liability in rental properties. It offers financial protection for tenants and ensures that their belongings are safe.

Types:

- Personal Property Coverage

- Liability Coverage

- Additional Living Expenses (ALE) Coverage

8. Umbrella Insurance:

Importance: Umbrella insurance provides additional liability coverage beyond the limits of other insurance policies. It offers an extra layer of protection against lawsuits and financial claims.

9. Travel Insurance:

Importance: Travel insurance covers unexpected events during trips, including trip cancellations, medical emergencies, and lost luggage. It ensures travelers have financial protection while away from home.

Types:

- Trip Cancellation Insurance

- Travel Medical Insurance

- Baggage Insurance

10. Pet Insurance:

Importance: Pet insurance covers veterinary expenses for pets. It ensures that pet owners can provide necessary medical care without financial strain.

Types:

- Accident-Only Coverage

- Accident and Illness Coverage

- Wellness Plans

11. Flood Insurance:

Importance: Flood insurance covers damage caused by floods, a peril not typically included in standard homeowners or renters insurance policies. It offers protection in flood-prone areas.

12. Cyber Insurance:

Importance: Cyber insurance safeguards businesses against data breaches, cyberattacks, and other digital risks. It is essential in today’s digital age to protect sensitive information and financial assets.

13. Motorcycle Insurance:

Importance: Motorcycle insurance offers protection for riders and their bikes in the event of accidents, theft, or damage. It is often required by law and provides financial security for motorcycle enthusiasts.

14. Boat Insurance:

Importance: Boat insurance covers watercraft and their owners from accidents, liability claims, and damage. It ensures that boat owners can enjoy their vessels with peace of mind.

15. Pet Insurance:

Importance: Pet insurance covers veterinary expenses for pets. It ensures that pet owners can provide necessary medical care without financial strain.

Types:

- Accident-Only Coverage

- Accident and Illness Coverage

- Wellness Plans

16. Renters Insurance:

Importance: Renters insurance covers personal property and liability in rental properties. It offers financial protection for tenants and ensures that their belongings are safe.

17. Umbrella Insurance:

Importance: Umbrella insurance provides additional liability coverage beyond the limits of other insurance policies. It offers an extra layer of protection against lawsuits and financial claims.

18. Travel Insurance:

Importance: Travel insurance covers unexpected events during trips, including trip cancellations, medical emergencies, and lost luggage. It ensures travelers have financial protection while away from home.

Types:

- Trip Cancellation Insurance

- Travel Medical Insurance

- Baggage Insurance

In conclusion, insurance is a versatile financial tool that provides protection against a wide array of risks. Whether it’s safeguarding your health, home, car, or business, insurance offers peace of mind and financial security. Understanding the various types of insurance and their importance is crucial for making informed decisions and protecting what matters most in life and business. By selecting the right insurance policies, individuals and companies can mitigate risks and ensure a more secure and prosperous future.

Leave a Reply