Introduction

Insurance fraud is a pervasive problem that affects both insurers and policyholders. It encompasses a range of deceptive practices aimed at securing financial gain through fraudulent insurance claims. In this comprehensive exploration, we will delve into the world of insurance fraud, dissecting its various types, discussing methods for detection, and highlighting strategies for prevention.

1. Understanding Insurance Fraud

We begin by defining insurance fraud and understanding its implications. Insurance fraud can take many forms, from exaggerated claims and staged accidents to false information on insurance applications. By recognizing the breadth of the problem, we set the stage for effective fraud prevention.

2. Types of Insurance Fraud

Insurance fraud comes in multiple forms, including healthcare fraud, auto insurance fraud, property and casualty fraud, and life insurance fraud. We will delve into each of these categories, outlining common schemes and methods used to perpetrate fraud.

3. The Consequences of Insurance Fraud

Insurance fraud has significant consequences for both insurers and policyholders. We will explore the financial impact of fraud on insurance premiums, the potential for criminal charges, and the erosion of trust within the insurance industry.

4. Detection and Investigation

Detecting insurance fraud is a multifaceted process that involves both technology and human expertise. We will discuss the methods and tools used to identify suspicious claims, including data analysis, red flags, and the role of special investigation units (SIUs).

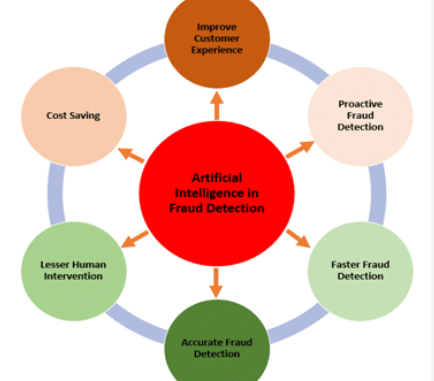

5. The Role of Technology in Detection

Advancements in technology have enabled more effective fraud detection. We will delve into the use of data analytics, artificial intelligence, and machine learning in identifying fraudulent claims, emphasizing how these tools enhance accuracy and efficiency.

6. Legal and Regulatory Measures

Legal and regulatory measures are vital for combating insurance fraud. We will explore the legislative framework and penalties for insurance fraud, emphasizing how these measures deter fraudulent activities.

7. Prevention Strategies

Preventing insurance fraud is just as critical as detecting it. We will discuss prevention strategies for insurers, including rigorous underwriting practices and educating policyholders about the consequences of fraudulent claims.

8. Consumer Education and Awareness

Educating consumers about insurance fraud is key to prevention. We will highlight the importance of consumer awareness, including recognizing common fraud schemes and reporting suspected fraudulent activity.

9. Industry Collaboration and Best Practices

Collaboration within the insurance industry and the adoption of best practices are essential for fraud prevention. We will explore the role of industry associations and the sharing of information to stay ahead of emerging fraud trends.

10. The Future of Insurance Fraud Prevention

The landscape of insurance fraud is continually evolving. We will discuss the future of fraud prevention, including the potential impact of blockchain technology, increased automation, and international cooperation in combating cross-border insurance fraud.

Conclusion

Insurance fraud is a complex and costly issue that demands vigilance and cooperation. By understanding the various types of insurance fraud, employing advanced detection methods, and implementing robust prevention strategies, the insurance industry and consumers can work together to mitigate the impact of fraud. In a world where trust is fundamental to the insurance sector’s integrity, tackling insurance fraud head-on is a shared responsibility that ensures the system remains fair, affordable, and trustworthy for all stakeholders.